It is a shift in the focus of discussions from the export of hydrogen to the full integration of the hydrogen economy into the country’s long-term development strategy that will allow Russia to realise its potential in this area, writes Yuriy Melnikov, Ph.D., Senior Analyst, Energy Centre, Moscow School of Management SKOLKOVO.

The world’s leading think tanks are unanimous that hydrogen will become a global energy carrier in the next 10-30 years. The reason is simple: a chemical element used for decades is now becoming more than just an ordinary “industrial gas” or a raw material for the chemical industry — the development of a hydrogen economy is now regarded as a necessary condition to achieve the Paris Agreement goals and to prevent the catastrophic consequences of global climate change. Seventeen countries have already published their hydrogen strategies, and more than 20 have begun to develop them. In Russia, the government began to investigate a hydrogen economy in 2020, and by the beginning of 2022 Russia may publish its own hydrogen strategy. Hydrogen export is still being called the main priority for the hydrogen economy development in Russia. In this article I will try to summarise the diverse views of stakeholders on this matter.

According to the International Energy Agency, following the NetZero scenario (a scenario for the world economy development opening possibilities to achieve the Paris Agreement goals and keep the increase in the global mean temperature at no more than 1.5°C higher than the preindustrial level), the world will need to increase the use of “carbon-free” (produced with a minimum carbon footprint) hydrogen from the current amount (close to zero) to 200 million tonnes by 2030 and 500 million tonnes by 2050. Hydrogen opens up opportunities for the deep decarbonisation of industries that are difficult to electrify — for example, steel production, fertilizers, the chemical industry, heavy and long-distance transport, etc. In order to implement such an ambitious scenario, governments around the world will have to make difficult decisions to rapidly expand the hydrogen economy and to reduce the cost of related technologies (economies of scale) — by analogy with how it was done at the beginning of the century with renewable energy. The key uncertainty in assessing the future volumes and growth rates of the hydrogen economy is whether the world community follows this scenario. However, the already approved national hydrogen strategies of Germany, Japan and South Korea are based on the total demand of only these three countries in the amount of 12 million tonnes by 2030.

In Russia, a hydrogen economy development targets were first set in the Energy Strategy approved by the government in the summer of 2020 — exports of 0.2 million tonnes by 2024 and 2 million tonnes by 2035. In August 2021, the government approved a concept for the development of hydrogen energy, which indicates more ambitious targets — up to 50 million tonnes and a 20% share of the global hydrogen market by 2050. The Russian hydrogen strategy is under development; its publication is expected in Q1 2022, but the focus on hydrogen export as the most important goal is still preserved in all official documents and public statements of officials and executives.

On the one hand, the hydrogen export from Russia looks like a very promising alternative to the current export of fossil energy sources (coal, oil, gas) taking into account inevitably decrease of demand for it as we move towards the NetZero scenario. Indeed, the key trading partners of Russia (the EU, Japan, South Korea, China) have set goals to achieve carbon neutrality by 2050-2060; their approved hydrogen strategies contain very specific indicators of hydrogen demand. Japan is developing hydrogen partnerships simultaneously with Australia, Brunei and Saudi Arabia, and Germany — with Canada, Chile, Morocco, Saudi Arabia, Russia, South Africa, and the Central African countries. It is quite probable that there will not be enough own resources for the production of hydrogen in Germany or Japan, and then the import of hydrogen will become inevitable for them. At the same time, Russia has great potential in the production of “carbon-free” hydrogen using a variety of sources and technologies — green, blue, and yellow. Moreover, a shipment interval from the Murmansk region or Yamal to Rotterdam, or from the Russian Far East ports to Japan look more advantageous than from Australia to Japan, for example. Thus, export-oriented hydrogen projects in Russia definitely have prerequisites. Stakeholders are already studying them, the most famous ones including the blue hydrogen project in Sakhalin (developed by Rosatom), the blue hydrogen or ammonia production project in Yamal (NOVATEK) and the green hydrogen production project in Murmansk region (Rosnano, Enel Russia).

On the other hand, it is still difficult to say whether such projects by themselves can become the basis for the of a hydrogen economy development in the country and, more broadly, a full-fledged replacement of the current energy-exporting economic model (energy export is the main source of the country’s export earnings and a GDP growth driver). First, there are more potential exporters of hydrogen than exporters of fossil energy resources — after all, hydrogen can be produced almost anywhere in the world. Russia will definitely not have such competitive advantages as it does now, for example, in natural gas supplies to the European market. Russia will have to compete in the production of hydrogen with the importing countries themselves, and with Chile, Saudi Arabia and Morocco. Second, the hydrogen economy as a whole is in its infancy; long-term investment guarantee mechanisms (like long-term supply contracts) are just beginning to be discussed. At the same time, the cost of hydrogen technologies (along the entire chain — from hydrogen production to its use by final consumers) is still too high for direct competition with hydrocarbons, and support measures are not intensive enough. In any export project, three questions will arise:

-

What is the amount of compensation for the difference between the cost of producing and transporting hydrogen for export and the price that a consumer in another country is willing to pay?

-

What is the source of funding for this difference? (as a rule, here we are talking about the scale of state support from both countries)

-

What are the long-term goals of allocating such support?

Third, export-oriented projects will be more vulnerable compared to the more complex projects of the so-called “hydrogen valleys” – with matching hydrogen production and demand in the immediate vicinity. Hydrogen valleys are created by consortia with the participation of dozens of companies (producing, transporting, using hydrogen, supplying services, etc.), as well as regional and federal governments. They have diversified funding sources ranging into the tens of millions of euros, a well-developed system of support measures and ready-made business models for participants. In this configuration, the risks for investors are significantly less than in a large-scale export project oriented for demand in thousands of kilometres from the place of supply.

If sea-based hydrogen transportation technology develops faster than the current rates, this can reduce the cost of the still very expensive logistics component and reduce the risks associated with export-oriented projects. South Korea’s hydrogen strategy, for example, is based on the likelihood of developing international hydrogen supplies along a model close to liquefied natural gas. The pipeline transportation of hydrogen is considered as an alternative — in particular, this issue is often raised in relation to Nord Stream 2 — but this does not fundamentally change anything. The existing gas transportation infrastructure is not suitable for the significant export of hydrogen; this may require large-scale modernisation. In any case, the modernisation of old gas pipelines or the construction of new hypothetical “hydrogen streams” will also require long-term guarantees for investors. So far there are no such guarantees.

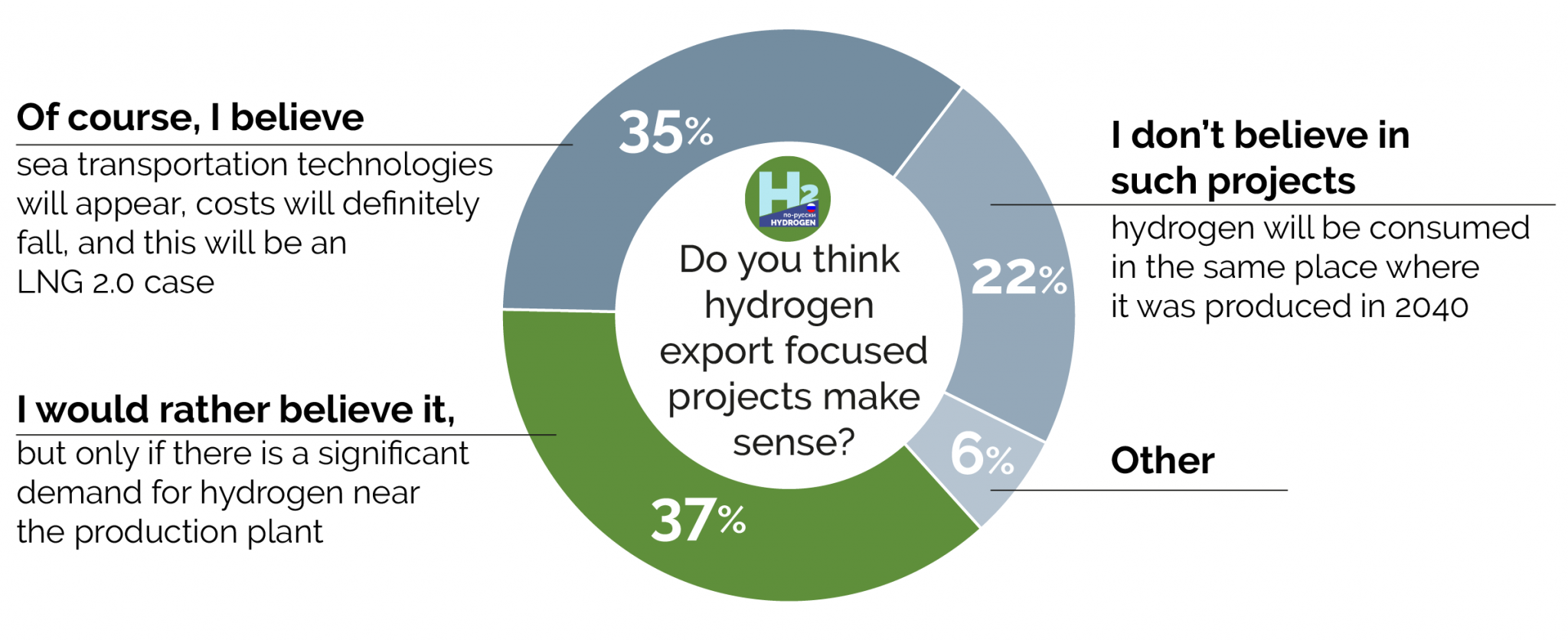

All these factors and trends are perceived differently in the Russian "hydrogen community" - from an unquestionably optimistic attitude towards export-oriented projects to calls to focus exclusively on domestic demand (see figure).

Distribution of answers to the question "Do you believe in export-oriented hydrogen projects?" September 2021, 260 respondents. Source: https://t.me/hydrogen_russia/349 (in Russian)

But the greater potential is hidden not in the hopes of controlling the world market through the “hydrogen OPEC” (this is impossible by definition), but rather in the integrated development of the hydrogen economy, which opens up opportunities for the rapid growth of the equipment manufacturers, engineering companies, and services. Russia also has potential here thanks to the achievements of domestic electrochemistry and petrochemistry. In addition, hydrogen in Russia could become an important area for decarbonisation — especially in perspective of the target to achieve carbon neutrality by 2060 (as was announced in mid-October).

A shift in the focus of discussions from the hydrogen export to the full integration of the hydrogen economy into the country’s long-term development strategy — with the development of Russian hydrogen technology, reduction of greenhouse gas emissions, improving air quality in cities, etc. — will allow Russia to realise its potential in this area.